|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

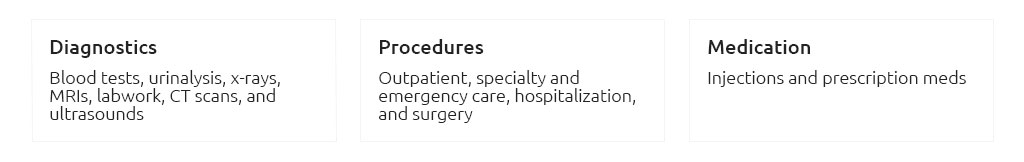

Understanding Local Pet Insurance: A Comprehensive GuideWhat is Local Pet Insurance?Local pet insurance is a type of coverage designed to help pet owners manage the financial risks associated with their pet's healthcare needs. It provides peace of mind by covering a portion of the veterinary expenses incurred due to accidents, illnesses, and other health issues. Choosing the right policy can be a daunting task, especially with various providers offering different levels of coverage and benefits. Types of CoveragePet insurance policies typically fall into one of three categories:

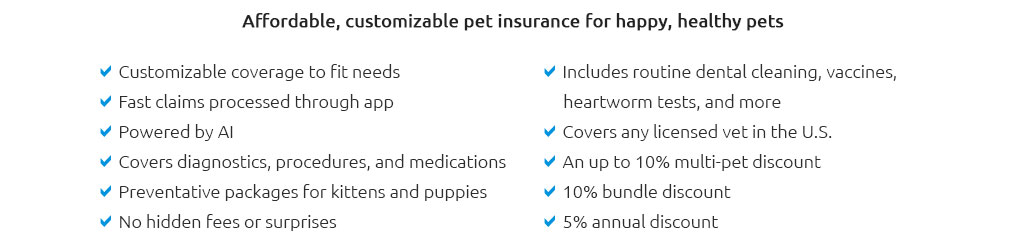

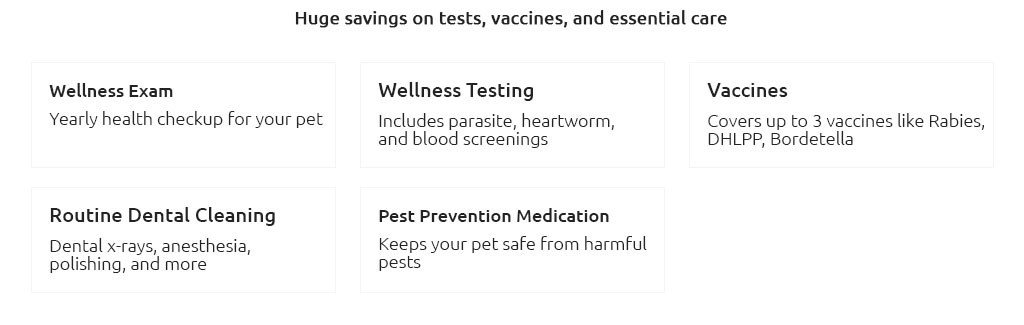

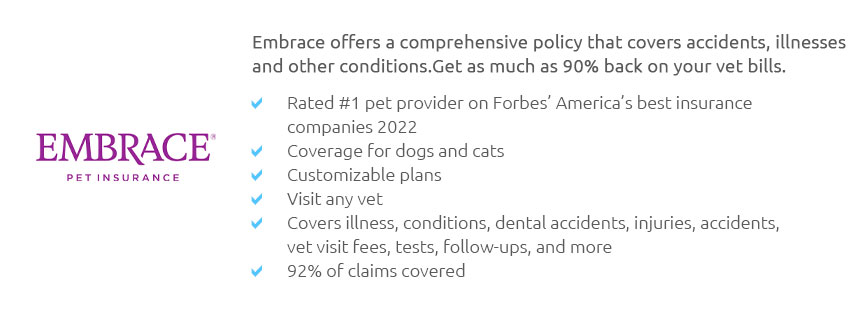

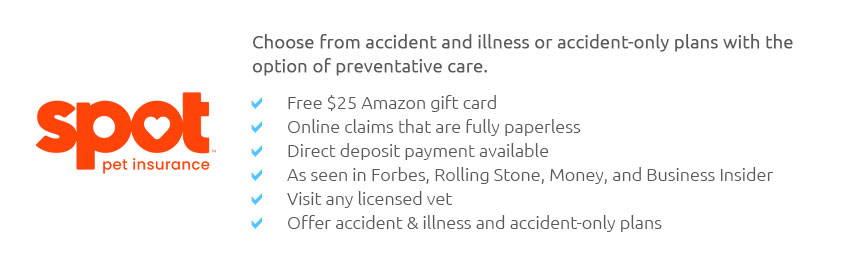

Benefits of Local Pet InsurancePet insurance offers numerous advantages to pet owners. It helps to reduce out-of-pocket expenses when unexpected veterinary bills arise. Furthermore, it enables pet owners to make healthcare decisions based on the best interest of their pet rather than financial constraints. Financial SecurityInsurance can shield you from the high costs of emergency procedures, surgeries, and treatments. For example, understanding the pet insurance hawaii cost can be crucial if you reside in Hawaii, where veterinary expenses might differ from other locations. Flexibility and CustomizationMany insurance providers offer customizable plans, allowing you to select the level of coverage that best suits your pet's needs and your budget. Some policies even include options for wellness and preventive care. Choosing the Right PolicyWhen selecting a pet insurance policy, it's essential to compare different plans and providers. Consider the following factors to ensure you choose the right one:

For instance, if you're considering a move, knowing the pet insurance in alaska options could offer you insights into regional differences. FAQWhat factors influence pet insurance premiums?Several factors can affect the cost of pet insurance premiums, including the pet's age, breed, and location, as well as the level of coverage and the deductible chosen by the owner. Is pet insurance worth it?Pet insurance can be a valuable investment, especially for pet owners who want to ensure that they can afford the best care for their pets without facing financial hardships. It provides a safety net for unexpected medical expenses. Can I insure an older pet?Yes, many insurance companies offer policies for older pets, though the premiums may be higher, and certain pre-existing conditions might not be covered. It's advisable to compare different providers to find the best option for senior pets. https://mwg.aaa.com/insurance/pet

Connect to your local AAA club's website. Enter ZIP Code. Submit. Looking for another AAA club? Visit AAA.com/stopAAA Mountain West Group proudly serves ... https://www.plymouthrock.com/insurance/pets

You can get a free, no-obligation quote in minutes through your local agent. You can also visit Fetch online or call them at 866-583-8478. Special coverages https://cluballiance.aaa.com/insurance/pet

Get your personalized AAA pet insurance policy from an Agent you can trust. Get my quote - 1-833-806-7833Find a local agent. Couple dancing with dog.

|